Inscriptions of the

01/08/2025 to 19/02/2026

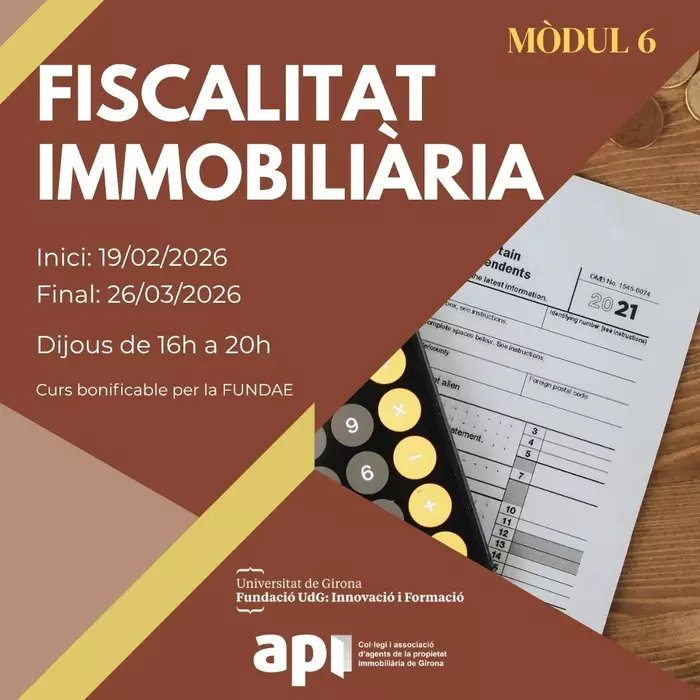

Date

Price

Vacancies

Week days

- Thursday

Timetable

Duration

Modalitat

Address

C/ Eiximenis, 18 entresòl - Girona

Type of query

Specialization Course in Real Estate TaxationCredits

3 ECTSTemary

The taxation of real estate operations in personal income tax: Taxation, deductions and reliefs.

Taxation of real estate operations in corporate tax (IS).

Tax on value added in real estate operations (VAT).

Taxation in the tax on property transfers and documented legal acts (ITP-AJD).

Gift and inheritance tax

Taxation of real estate and real estate operations in the field of local taxes.

Taxes on non-residents (income imputations, sales and rental income).

Specific specific cases.

Tax on stays in tourist establishments (tourist tax). Problem with VAT.

.jpg)

Speakers

Jaume Pagès Licenciado en ADE. Asesor fiscal en Pagès & Logde.

Joan Robleda, Economist

Maria Romaguera Degree in ADE. Administrative manager. RM Assessors tax adviser

Evaluation system

Minimum attendance to 80% of the sessions.Test type test

Discount

20% discount for members of the organizing entities and employees of these schools €276.00

5% discount for professional associations €327.75